Asset Finance

Asset Finance Options For Your Business

The right asset finance option is a time-saving and cost-effective investment move to grow your business in the long term. It can also offer protection against the risk associated with obsolete equipment while providing a number of tax benefits.

As a business owner, it is important that you consider the many different assets you can use finance. These assets can include personal and commercial vehicles, shop fit-outs and heavy machinery. At Loan Pros we offer many asset financing options, such as furniture, office technology, retail shops, factories, warehouses and medical institutions.

If you think asset finance is right for you, here are some important considerations to make:

- Amount of capital you will need to grow your business

- Projected time frame to resolve issues in your cash flow

- Tax outcome in case you apply for asset financing

- Length of time you will use the equipment and possibility of a future upgrade

- Potential of risks and changes that could affect the industry you belong to

- Choice between a “finance-to-own” and a “finance-to-return” for your asset

In general, the options involved in asset finance include:

- Commercial Hire Purchases

- Novated Leases

- Chattel Mortgages

- Technology Rentals

- Financial and Operating Leases

Each one these asset finance option comes with its own advantages and limitations in particular when applied to commercial purposes. Before making your decision, it is a good idea to talk to your tax adviser or accountant. They will help you to understand the issues further, here is a brief summary of the different kinds of asset finance available:

Commercial Hire Purchase

This type of financing rents out the asset to you. After you make the last payment, ownership is transferred to you. You can customize the payment options, deposit amount and loan period. If you prefer, you can even make a large final payment. You could also negotiate a structured payment scheme if cash flow ever becomes a problem.

Chattel Mortgage

This is one of the most popular asset financing options that allows you to use an asset you already own to take out a secured loan. With this type of financing, you can customize your payment terms for a maximum of five years. You can also pay a deposit and make a bigger final payment. This type of financing also allows you to make structured payments to help you with cash flow issues.

Finance Lease

Finance lease allows you to take out a loan secured by an asset owned by the financier. The catch is that you take on the responsibility of its disposal once the lease ends. This is an excellent option wherein you can make use of the latest equipment without having to shell out a large capital. You can pay off the loan through advance lease payments or through arrears with a maximum loan period of five years. Note that this type of financing requires residual value in accordance with the use of the asset and the guidelines set by the Australian Taxation Office.

Operating Lease

An operating lease is utilised for the funding of several different assets. The payments made can be declared as operating cost. Hence, it will not be declared as a liability. This type of lease allows you to lower the risk associated with obsolete equipment.

Novated Lease

A novated lease allows you to make a vehicle loan with your employer. The asset belongs to the financier but the borrower and the employer share the responsibility of paying off the loan under a novation agreement. The term of the loan can be as short as 12 months or as long as 5 years. The monthly payments and the residual payment will be calculated based on the borrower’s current circumstances and the guidelines provided by the Taxation Office. If a novated lease seems like a good option, discuss its potential with your human resources department.

Fleet Operating Lease

This finance option allows you to use an asset (a vehicle or vehicles in this case) during the loan term, then return it to the financier at completion, usually after 12 months or up to five years. Ownership of the asset remains with the financier. Monthly payments are fixed and cover insurance, servicing, maintenance and registration. If you are a small business, this financing option can help you manage the resources you currently have.

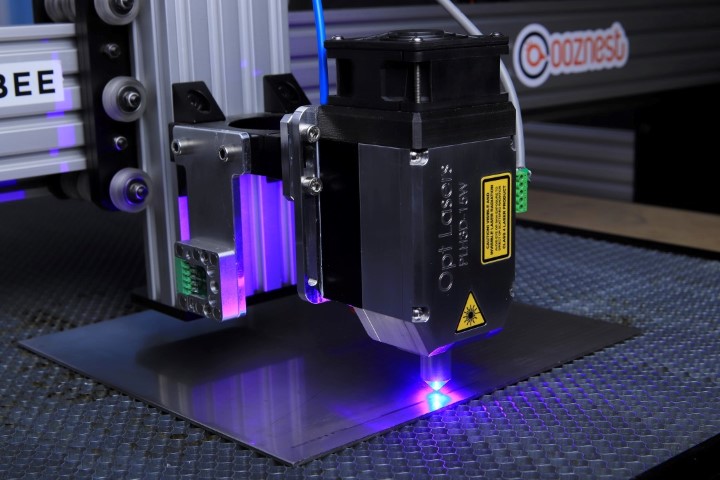

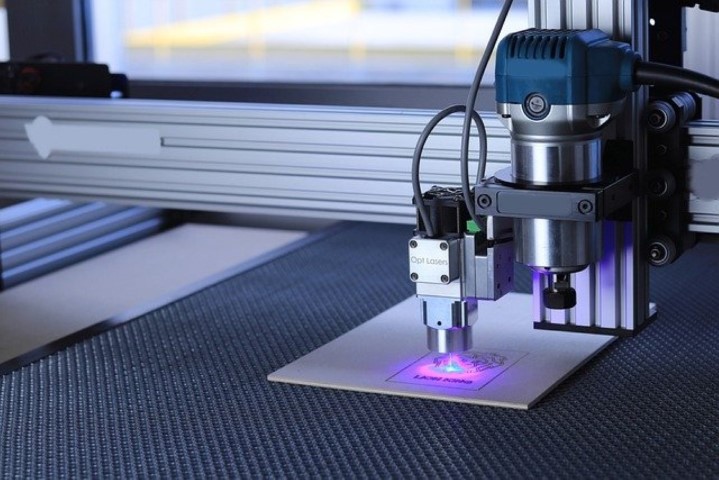

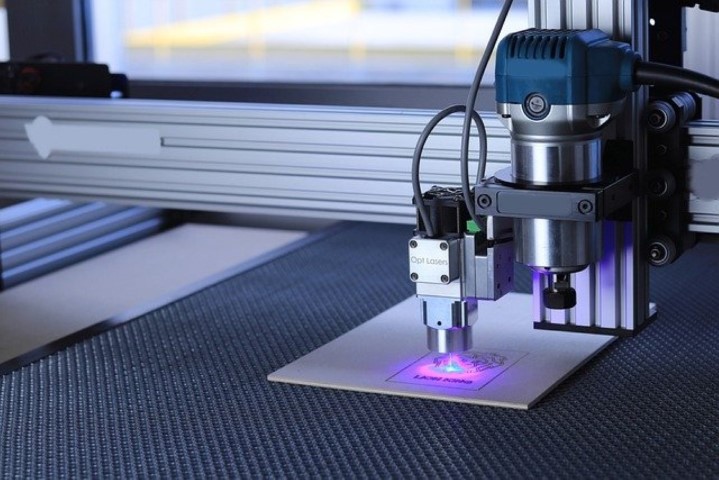

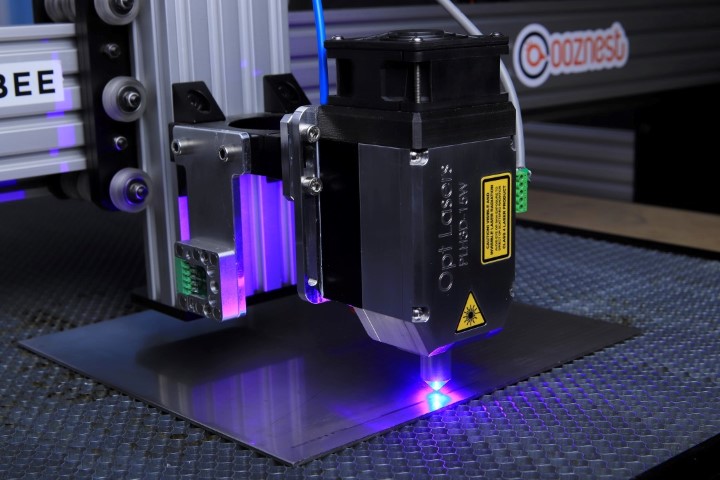

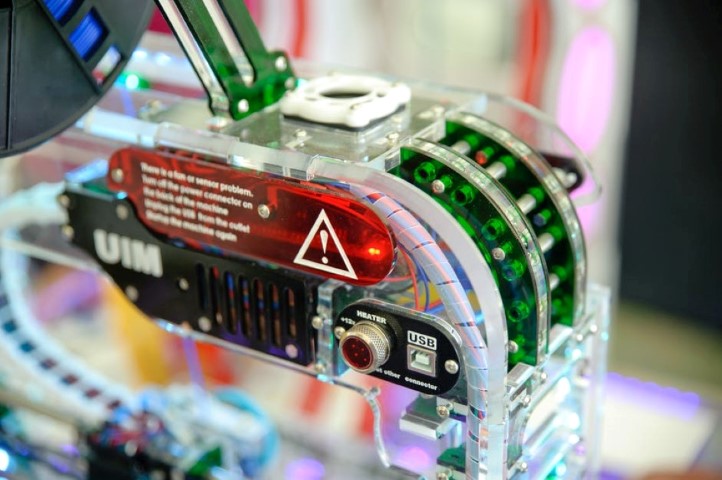

Technology Lease/Rentals

Change in technology happens quickly, so business owners often have to pay a huge amount upfront, thus hindering their cash flow. By renting technology, you can reduce the risk associated with obsolete equipment and still preserve your cash flow.

Ownership of the equipment remains with the financier and the borrower is required to return it when the loan term ends. This financing option has flexible terms that allow the borrower to tailor the loan payments based on their business requirements and circumstances.

Asset Finance Help

If you want to know which type of asset finance option is best for you, call us for a complimentary discussion.

Our Core Values

Loan WA is an award winning brokerage company because we try the hardest to help you

Trust

Focus

Integrity

Excellence

Consistency

Team work

Let's chat; it's free and no obligation

Get in touch with Rob for a comprehensive asset finance assessment.

We Are Always Focused On

YOU

Investment

Investment to grow your business.

Home Loans

No matter how big or small.

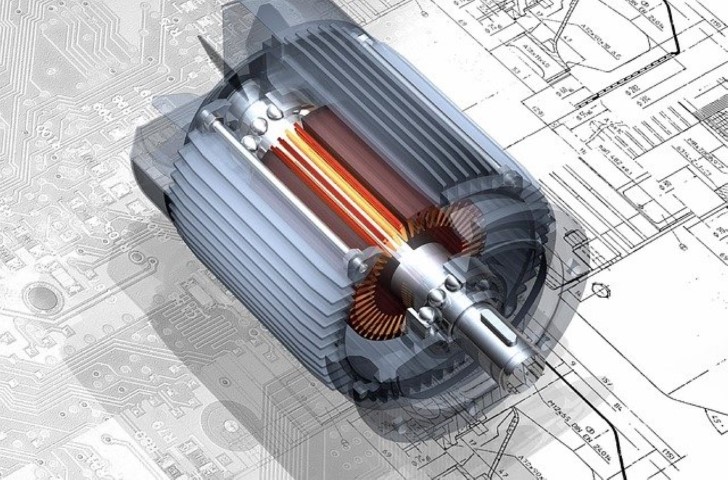

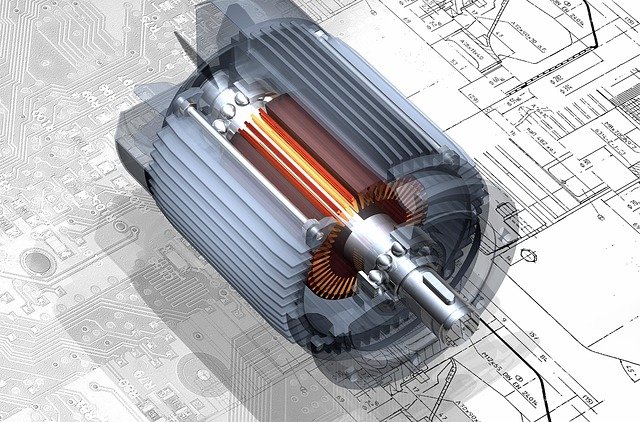

Asset Finance

Asset finance includes loans for your machinery or car.

Personal Loans

Tell us what you need we do the rest.

We are here to help ...

Meet Us At

Offices

Perth Office

213/396 Scarborough Beach Rd

Osborne Park WA 6017

- (08) 9208 1700

- [email protected]

Mandurah Office

Mandurah

- (08) 9208 1700

- [email protected]