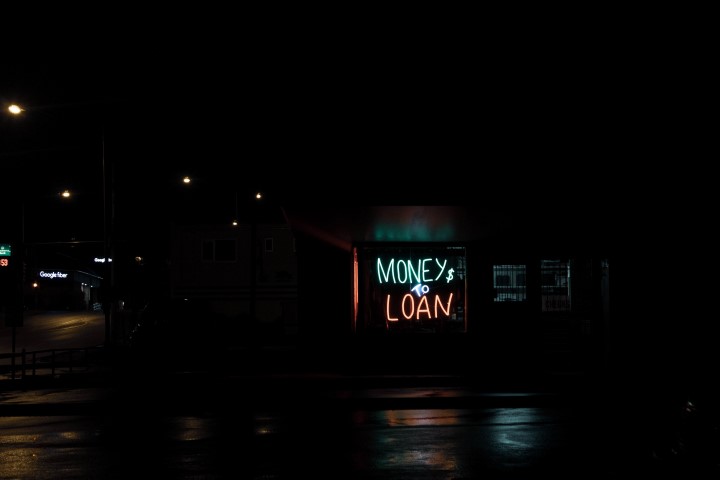

Unsecured Personal Loans

Unsecured Personal Loans

So, you’re moving along in your business quite nicely and have far more incoming work than you can actually handle. It may be time for you to consider expanding and this will definitely require some cold, hard cash. One easy way to increase the amount of money you have available is by using unsecured loans. Unsecured loans are fast, easy and entail a lot less red tape, but is your company ready for these funding products?

How Unsecured Loans Are Different From Other Funding Types

With an unsecured loan, you don’t have to have collateral to back the funding that’s being offered such as a house or another high-value asset, while secured loans require you to place insurance against your debt with collateral. Lenders take on more risk when offering unsecured loans and for borrowers, this usually means taking on a higher interest rate.

Depending upon the size of your business, unsecured loans can range from $5k to $500k, but they aren’t solely used for resolving short-term cash flow issues – it is still necessary to meet the credit and income requirements for these financial products. There are various business factors upon which loans are approved including the average monthly sells for the company, the amount of time that the business has been in operation and the amount of time spent at the current business address among other things.

The Benefits of Unsecured Loans

It isn’t necessary to put up your house: Your company should be a self-funding enterprise and with unsecured loans, you don’t have to mix your personal and business finances. In the unlikely event of bankruptcy, an unsecured loan can be discharged by the court, but the court will not discharge loans that are secured. Moreover, given that you don’t have to leverage your home for a loan that’s unsecured, you will still have the option of using your equity for a secured funding product, should you another investment opportunity arise.

The application process is fast and hassle-free: Lenders will consider your credit report and your credit score to ensure that no red flags exist – the process should be a straightforward one. Some loans can even be routed to your banking account within just 24 hours.

The Drawbacks of Unsecured Loans

Shorter payment windows and higher interest: Lenders take on more risk when no collateral is used. Due to this fact, they usually charge higher interest rates and require the funds to be restored within a much shorter period of time. For instance, you might get a 15-year repayment term with a secured loan, while unsecured loans could give you just three or four years.

Less funding: Lenders will not hand out money unless they are certain that you can repay it. If there is no collateral for the loan, then your lender will only approve a funding amount that it can comfortably afford to lose.

The loan structure is rigid and very unforgiving: After you have agreed to use an unsecured loan, restructuring your loan agreement could prove quite difficult. More importantly, unsecured loans may come with considerable prepayment penalties for attempting to pay them off faster. In short, once you sign for and accept unsecured loans, you’re essentially locked in – irrespective of any changes that might occur in your business or your personal life.

Is An Unsecured Loan The Right Choice For You?

Take some time to consider the benefits and drawbacks of unsecured loans before simply diving right in so that you can accurately determine whether or not your business is capable of managing this debt and whether you really need this cash.

Following is a list of questions for determining whether these loans are right for you:

- Will you have sufficient income over the next several months for managing your new loan payments?

- Will this loan make your company more profitable?

- Have you chosen a reputable lender?

- Can you provide your company’s ability to manage the loan?

- Are you in possession of all the necessary documentation such as lease agreements, bank statements, cash-flow and income statements?

- Have you learned the tax implications of unsecured funding?

- Do you know which charged and fees are associated with the loan?

The Federal Government is currently helping small businesses so you should also research the grants that can help your company attain the next level of growth.

Unsecured Personal Loans Help

If you want to know which type of unsecured personal loans finance option is best for you, call us for a complimentary discussion.

Our Core Values

Loan WA is an award winning brokerage company because we try the hardest to help you

Trust

Focus

Integrity

Excellence

Consistency

Team work

Let's chat; it's free and no obligation

Get in touch with Rob for a comprehensive personal loan (unsecured) assessment.

We Are Always Focused On

YOU

Investment

Investment to grow your business.

Home Loans

No matter how big or small.

Asset Finance

Asset finance includes loans for your machinery or car.

Personal Loans

Tell us what you need we do the rest.

We are here to help ...

Meet Us At

Offices

Perth Office

213/396 Scarborough Beach Rd

Osborne Park WA 6017

- (08) 9208 1700

- [email protected]

Mandurah Office

Mandurah

- (08) 9208 1700

- [email protected]